A typical SaaS demand generation or marketing operations leader is under constant pressure to show results. And in many organizations, results are still measured by one thing: lead volume.

That mindset is understandable. Dashboards reward big numbers. Reports highlight how many contacts were added to the CRM. Vendors proudly showcase how many leads they can deliver.

But here’s the uncomfortable truth most SaaS teams eventually discover:

Roughly 70% of syndicated B2B leads never convert into pipeline – let alone revenue.

That means for every 10 leads acquired through content syndication, only a few may ever progress into meaningful sales conversations. The rest often look fine on paper but fail to move the business forward.

Some leads come from the wrong company size. Others are in non-buying roles. Many simply wanted the content and had no intent to evaluate software.

Meanwhile, sales teams waste cycles following up on leads that never respond, never book demos, and never turn into opportunities.

By the time this becomes obvious, budgets have already been spent and trust between marketing and sales has taken a hit.

This is where SaaS teams need to change how they evaluate content syndication.

This article focuses specifically on how SaaS companies should track what actually converts in content syndication – not just leads, but pipeline, revenue influence, and buying intent.

If you’re looking for a broader, industry-agnostic framework for measuring content syndication, we’ve covered that separately in our complete guide to measuring B2B content syndication performance.

This article zooms in on the SaaS reality.

What “Good” Content Syndication Looks Like for SaaS Companies

Before measuring performance, SaaS teams must clearly define what success looks like.

For SaaS, effective content syndication is not about the biggest lead list. It is about consistently generating leads that progress through your funnel and influence revenue.

Strong B2B SaaS content syndication delivers:

1. ICP-Aligned Leads

Leads match your ideal customer profile based on:

- Company size and revenue range

- Industry or vertical

- Buying role (e.g., Demand Gen, RevOps, IT, Engineering, Finance)

- Tech maturity and stack compatibility

These are leads your sales team would actually want to talk to.

2. Funnel-Stage Relevance

SaaS buying journeys are long and multi-touch. Content must align with where the buyer is:

- Top-of-funnel: Educational guides, industry research, problem awareness

- Mid-funnel: Webinars, comparison guides, frameworks

- Bottom-of-funnel: Case studies, ROI tools, competitive breakdowns

A mismatch here creates “leads” that never activate.

3. Clear Down-Funnel Movement

For SaaS teams, success means:

- Demo requests

- Trial signups

- Product-qualified signals

- Opportunities created

- Pipeline dollars influenced

If leads stall at MQL, syndication isn’t working – regardless of volume.

Once this definition is clear, measurement becomes much more precise.

SaaS Metrics That Actually Indicate Syndication Success

Counting leads alone hides problems. SaaS teams need to track signals that indicate buying intent and revenue impact.

Here are the metrics that actually matter.

1. MQL → SQL → Opportunity Conversion Rates

Track how many syndicated leads:

- Become MQLs

- Are accepted by sales as SQLs

- Convert into real opportunities

A low MQL-to-SQL rate often signals poor targeting or content mismatch.

2. Pipeline Influence and Pipeline Value

Ask a critical question:

How much pipeline can be directly attributed to content syndication?

This includes:

- First-touch attribution

- Multi-touch influence

- Assisted conversions

Pipeline value is far more meaningful than lead counts.

3. Cost per Opportunity (CPO) and Cost per Acquisition (CPA)

Two networks may deliver very different ROI.

Example:

- Network A: 200 leads → 1 opportunity → $0 closed

- Network B: 50 leads → 10 opportunities → $180K pipeline → $40K ARR

Volume favors Network A. Revenue favors Network B.

SaaS teams should optimize for cost per opportunity and cost per ARR, not cost per lead.

4. Engagement and Intent Signals

SaaS buyers reveal intent through behavior:

- Email engagement

- Webinar attendance

- Return website visits

- Pricing page views

- Trial activation events

Syndicated leads that show post-download engagement are far more valuable than silent names in a database.

5. Conversion Rate by Content Asset and Partner

Not all content – or partners – perform equally.

Track:

- Which assets lead to demos or trials

- Which partners deliver high-intent buyers

- Which campaigns stall early

This insight is where optimization begins.

How SaaS Teams Should Implement a Conversion-Focused Measurement System

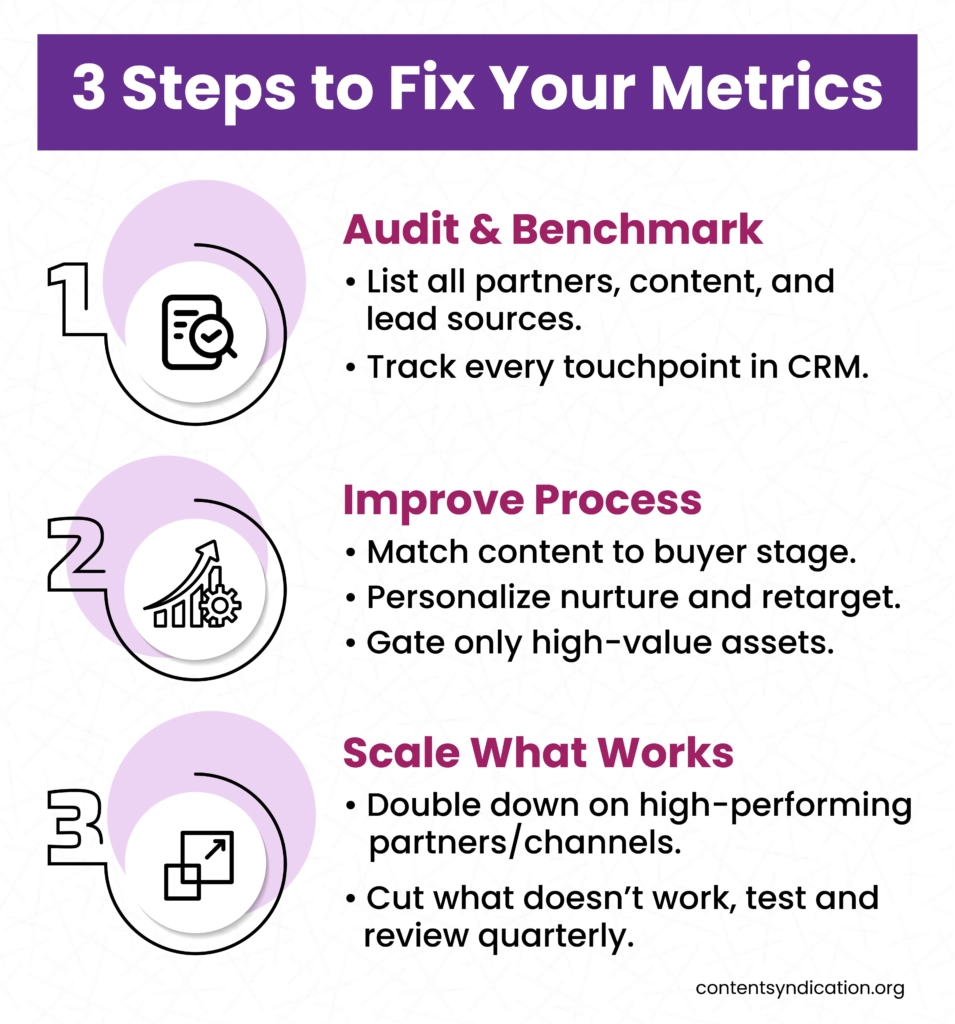

Here’s a simple 3-step system SaaS teams can use to fix syndication performance and focus on conversions instead of lead volume.

Step 1: Audit and Benchmark Your Current Syndication Efforts

Most SaaS teams lack visibility into what happens after the lead is captured.

Start by auditing:

- All syndication partners used in the last 6–12 months

- Every content asset promoted

- How leads are tagged in your CRM (source, partner, asset, UTMs)

- Where leads go next: nurture, sales, or nowhere

Then answer:

- Which leads became MQLs, SQLs, and opportunities?

- Which assets generated engagement beyond the first click?

- What feedback does sales have on lead quality?

This audit creates your baseline – without it, optimization is guesswork.

Step 2: Improve the SaaS Syndication Process

Once you have clarity, it’s time to fix what breaks conversion.

Content Relevance for SaaS Buyers

Many SaaS teams overuse the same content across every funnel stage.

Instead:

- Use educational assets for early awareness

- Use comparison and framework content for evaluation

- Reserve case studies and ROI tools for late-stage buyers

Refresh assets regularly and test formats like:

- Interactive calculators

- On-demand webinars

- Short, focused reports

Gate only content that genuinely deserves a form fill.

Smarter Nurture and Retargeting

Generic nurture kills otherwise good SaaS leads.

Best practices:

- Immediately segment syndicated leads by asset, partner, and persona

- Customize nurture tracks based on first interaction

- Retarget engaged leads with demo or trial-focused messaging

- Use LinkedIn and programmatic ads to reinforce relevance

The goal is progression – not inbox noise.

Step 3: Scale Based on Pipeline, Not Assumptions

SaaS teams often scale what looks good instead of what converts.

Do this instead:

- Increase spend on partners that consistently generate pipeline

- Pause campaigns with low SQL or opportunity rates

- A/B test assets, targeting, and messaging continuously

- Review performance quarterly using pipeline and ARR metrics

Scaling without measurement multiplies waste. Scaling with clarity multiplies impact.

Stop Chasing Lead Volume. Start Chasing SaaS Revenue.

SaaS growth is not driven by how many leads you collect – it is driven by how many buyers you convert.

Content syndication can absolutely fuel pipeline and revenue, but only when SaaS teams measure what matters:

- Opportunity creation

- Pipeline influence

- Revenue contribution

- Intent signals

When you shift your focus from volume to conversion, content syndication stops being a cost center and becomes a predictable growth lever.

That is how SaaS companies turn syndicated content into real business outcomes – not just bigger dashboards.