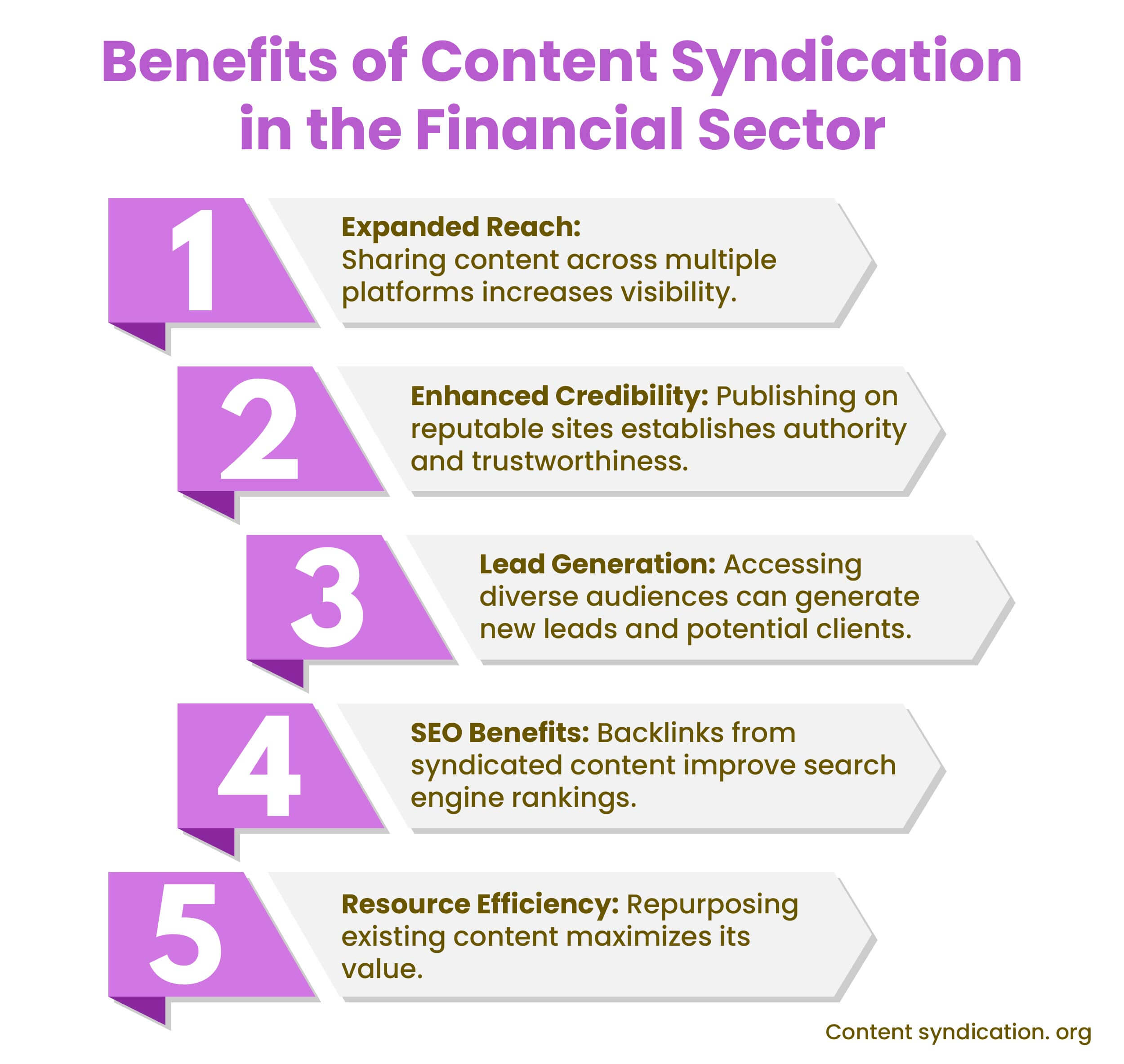

In most cases, the ROI of financial content syndication depends on the expertise of the content syndication vendors you choose. In the highly regulated and trust-oriented financial industry, reaching new audiences through content marketing can be challenging. Content syndication offers a strategic solution to amplify your brand’s visibility and engage potential clients effectively.

Key Elements of Financial Content Syndication

Financial content syndication involves distributing your articles, reports, and analyses to third-party platforms frequented by your target audience. This strategy not only broadens your reach but also drives traffic back to your website, fostering engagement and generating potential leads. It’s crucial that syndicated content aligns with your brand’s messaging and maintains consistency across all channels.

Top Financial Content Syndication Platforms

Selecting the right platforms is vital for effective syndication. Consider the following options:

1. LinkedIn:

As a professional networking site, LinkedIn enables sharing content with a business-focused audience, enhancing brand visibility among industry professionals.

2. Taboola:

A content discovery platform connecting publishers and advertisers, allowing financial brands to distribute content to a vast audience.

3. Outbrain:

Similar to Taboola, Outbrain facilitates content recommendations on premium publisher sites, increasing exposure to potential clients.

4. Flipboard:

A platform that curates content from various sources, enabling financial brands to reach readers interested in finance and economic news.

Must Read: Content Syndication Platforms for B2B Lead Generation

How to Choose the Right Financial Syndication Partners

Selecting appropriate content syndication partners is crucial for maximizing the impact of your financial content. Consider the following factors:

1. Audience Alignment:

Ensure the syndication partner’s audience matches your target demographic to maximize relevance and engagement.

2. Industry Expertise:

Choose partners with a strong presence in the financial sector. Their industry expertise ensures your content is presented within the appropriate context, enhancing credibility and relevance.

3. Content Quality and Relevance:

Evaluate the quality of content published by potential partners. High-quality, relevant content indicates a reputable platform that can positively influence your brand’s perception.

4. Distribution Channels and Reach:

Assess the partner’s distribution network and audience reach. A broad and engaged audience can amplify your content’s visibility and effectiveness.

5. Compliance and Regulatory Adherence:

Financial content is subject to strict regulations. Ensure the syndication partner adheres to industry standards and compliance requirements to avoid legal complications.

6. Analytics and Reporting:

Opt for partners that provide detailed analytics and reporting. Access to performance metrics allows you to measure the success of your syndicated content and make data-driven decisions.

7. Reputation and Credibility:

Research the partner’s reputation within the industry. Positive reviews, testimonials, and a proven track record are indicators of a trustworthy and effective syndication partner.

8. Flexibility and Customization:

Choose partners that offer flexibility in content presentation and distribution. The ability to customize syndication strategies ensures alignment with your brand’s specific goals and messaging.

By carefully evaluating these factors, you can select financial content syndication partners that enhance your content’s reach, credibility, and impact within the target audience.

Best Practices for Effective Financial Content Syndication

To maximize the benefits of content syndication, implement strategies that preserve your content’s integrity, enhance its reach, and maintain strong engagement with your audience. Key practices include:

1. Maintain Originality:

While syndicating your content across various platforms, ensure each piece remains unique and valuable. This approach provides fresh insights to different audiences and helps avoid duplication penalties from search engines.

1. Customize Content:

Tailor your content to suit the specific audience and guidelines of each syndication platform. This customization can involve adjusting the tone, style, or examples used to better resonate with the target readers.

2. Update Information:

Regularly revise your content to include the latest data, trends, or developments in your industry. This practice ensures your content remains relevant and authoritative.

3. Add Unique Value:

Incorporate exclusive insights, case studies, or perspectives not available elsewhere. This uniqueness enhances the appeal of your content and encourages sharing.

2. Use Canonical Tags:

Canonical tags are HTML elements that help search engines identify the original source of a piece of content, thereby preserving its SEO value. Implementing canonical tags is vital when syndicating content to prevent duplicate content issues.

1. Coordinate with Syndication Partners:

Ensure your syndication partners include a canonical link back to the original article on your website. This practice signals to search engines that your site is the primary source.

2. Consistent Implementation:

Apply canonical tags consistently across all syndicated versions of your content. This uniformity helps maintain your site’s authority and search rankings.

3. Monitor for Compliance:

Regularly check that syndication partners adhere to the agreed-upon use of canonical tags. Address any discrepancies promptly to safeguard your SEO efforts.

3. Engage with the Audience:

Active engagement with your audience on syndicated platforms fosters relationships and enhances your brand’s presence.

1. Monitor Interactions:

Keep track of comments, shares, and discussions related to your syndicated content. This monitoring allows you to understand audience sentiment and gather feedback.

2. Respond Promptly:

Address questions, comments, or concerns in a timely and professional manner. Engaging in conversations demonstrates your commitment to your audience and builds trust.

3. Encourage Dialogue:

Pose questions or invite opinions within your content to stimulate discussion. Encouraging dialogue can lead to deeper engagement and a more invested readership.

4. Leverage Feedback:

Use the insights gained from audience interactions to refine your content strategy and address the needs and interests of your readers more effectively.

By maintaining originality, utilizing canonical tags, and actively engaging with your audience, you can enhance the effectiveness of your content syndication efforts, ensuring broader reach and sustained audience interest.

Future Trends in Financial Content Syndication

The landscape of content syndication is evolving with trends such as:

1. AI-Powered Personalization:

Leveraging artificial intelligence to tailor content recommendations, enhancing user engagement.

2. Interactive Content Formats:

Incorporating interactive elements like quizzes and calculators to increase audience participation.

3. Enhanced Data Analytics:

Utilizing advanced analytics to gain deeper insights into content performance and audience behavior.

In Conclusion

When executed effectively, content syndication enhances brand authority and attracts high-quality leads. By thoughtfully selecting syndication partners, adhering to best practices, and staying informed about emerging trends, financial brands can leverage content syndication to achieve their marketing objectives. Such collaboration can simplify the complexities of content distribution, allowing your team to focus on core business activities while ensuring your content reaches the right audience.

Frequently Asked Questions (FAQ)

What is financial content syndication, and how does it work?

Financial content syndication involves republishing financial content like reports, thought leadership articles, or investment insights on trusted third-party platforms. This helps financial brands expand reach, build authority, and drive qualified traffic back to their site while maintaining regulatory compliance.

Can you give an example of financial content syndication?

Sure. A financial firm publishes a whitepaper on “Wealth Management Trends 2025” on its website and then syndicates it via LinkedIn, Outbrain, and Flipboard. These platforms present the content to high-intent audiences, driving readers to a lead capture landing page on the firm’s website.

Is there a template for syndicating financial content?

Yes. Here’s a simple financial content syndication template:

- Title: [Clear, Insightful, Benefit-Driven]

- Intro Paragraph: Summarize value + target persona relevance

- CTA Block: Download, Read More, or View Report

- Canonical Tag: Pointing to your original source

- Tracking: Add UTM parameters for source analytics

This ensures consistency, compliance, and performance tracking.

What are the best content syndication platforms for finance?

Some of the top platforms for syndicating financial content include:

- LinkedIn Sponsored Content

- Taboola

- Outbrain

- Investopedia (paid native placements)

- Business Insider Partner Network

Each platform serves different funnel stages—from awareness to lead capture.

Are there free content syndication sites for financial brands?

Yes, a few platforms allow limited free syndication or self-publishing:

- Medium

- Reddit (in niche finance subreddits)

- Flipboard (as a curated magazine)

- Quora (for thought leadership answers linking back to original content)

- Slideshare (for visual formats like reports or decks)

However, always ensure compliance with your firm’s branding and legal guidelines.

What are the top B2B content syndication platforms for financial services?

For B2B financial marketing, these platforms are highly recommended:

- NetLine

- Only B2B

- TechnologyAdvice

- Content Syndication Hub

- LeadScale

These platforms help generate Marketing Qualified Leads (MQLs) through gated content targeting decision-makers in finance, insurance, and fintech.

Which content syndication companies specialize in B2B finance?

Some reputed B2B content syndication companies with financial expertise include:

- Only B2B – known for multi-channel syndication in fintech

- INFUSE Media – focuses on full-funnel demand gen

- ActualTech Media – often used for financial tech topics

- DemandWorks – caters to compliance-sensitive industries

Choose based on audience fit, lead qualification processes, and compliance handling.

What are content syndication networks and how do they benefit financial brands?

Content syndication networks are groups of websites and platforms that republish or promote your content across multiple high-traffic destinations. For financial brands, these networks ensure that thought leadership content reaches C-level decision-makers, investors, and finance professionals—without needing to build each channel manually.

What type of content works best for financial syndication?

The following content types tend to perform exceptionally well:

- Educational Guides & How-To Articles

Topics like “How to Choose the Right Retirement Plan” or “A Beginner’s Guide to Tax-Efficient Investing” perform well because they provide tangible value. - Whitepapers & Research Reports

In-depth resources such as “2025 Wealth Management Trends” attract decision-makers in B2B finance. - Webinars & Expert Panels

Syndicating webinars with industry experts can drive qualified leads and build credibility. - Case Studies & Success Stories

Sharing real-world examples of financial success stories helps build trust and convert mid-funnel prospects. - Infographics & Visual Data

Market insights presented visually—such as economic forecasts or investment comparisons—perform well across content syndication networks. - E-books & Checklists

Assets like “10-Step Checklist for Tax Planning” or “Ultimate Guide to Financial Planning for SMBs” are great for gated content syndication and lead capture. - Compliance & Regulatory Updates

Content on changing laws, compliance frameworks, or tax reforms attracts niche, high-intent traffic.